- [email protected]

- 1374 Trenton Circle San Jacinto, CA 92583

“We Help Our Clients Eliminate Predictable Crisis And Increase Earnings By Driving Down Insurance and Cost Of Risk. The Remedy Is To Effectively Manage The Insurance Cycle And Transfer Risk Where Possible. This Is Deeply Gratifying Work.”

- Don Bury

Designed for hurried businesspeople. (You Do Not Have To Read The Buyer’s Guide To Business Insurance or Do a Bunch Of Time-Consuming Work!)

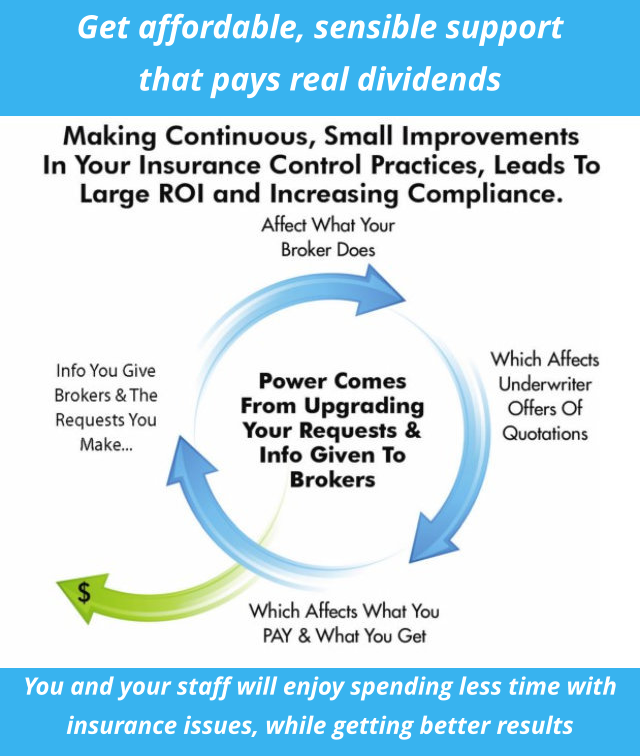

Insurance and risk management is a poorly controlled function in most organizations. Establishing order and control is usually very rewarding and can generate ROI s in the 1,000%+ range.

If you cannot or do not publish a complete RFP 90 days prior to an insurance expiration you are highly vulnerable to overpaying for insurance, as well as suffering exposure to errors and omissions in coverage and poor service.

If you do have a complete RFP and do nothing more than use it to collaborate with your broker, expect your net cost of risk to go down. Handing your broker your RFP positions you as a powerful, informed buyer with demonstrated walk-away power that turns into money for you.

A complete RFP must include:

Most people flunk the complete RFP test, which is a primary reason most people pay more than necessary for insurance.

Our Service Offer – $3,000 for a 15 hour block of service organized to create success for people who have no time to deal with insurance.

Our Guarantee is a full refund at the 15 hour mark if you regret your decision.

Currently we offer a 15 hour block of service time, which is sufficient for most small businesses to get through an entire renewal cycle. If additional time is needed, we bill hourly subject to your approval in advance.

Don Bury, Compassionate About The Pain And Frustration Insurance Buyers Experience Dealing With An Industry That Forgets Who Is Writing The Checks.

That happened In 1992. Driven by compassion for clients, I had spent a full year writing The Buyer’s Guide To Business Insurance, showing people simple actions to get more from commercial brokers and actually control their insurance. They saw that behavior as “not committed to the business”. I guess they had a point.

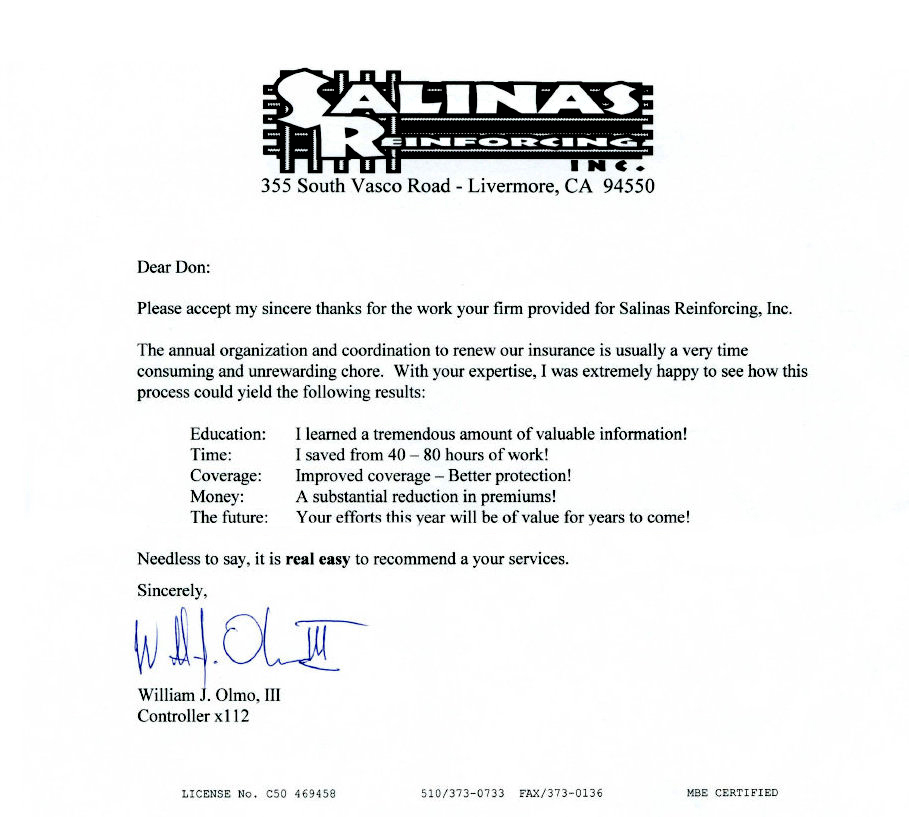

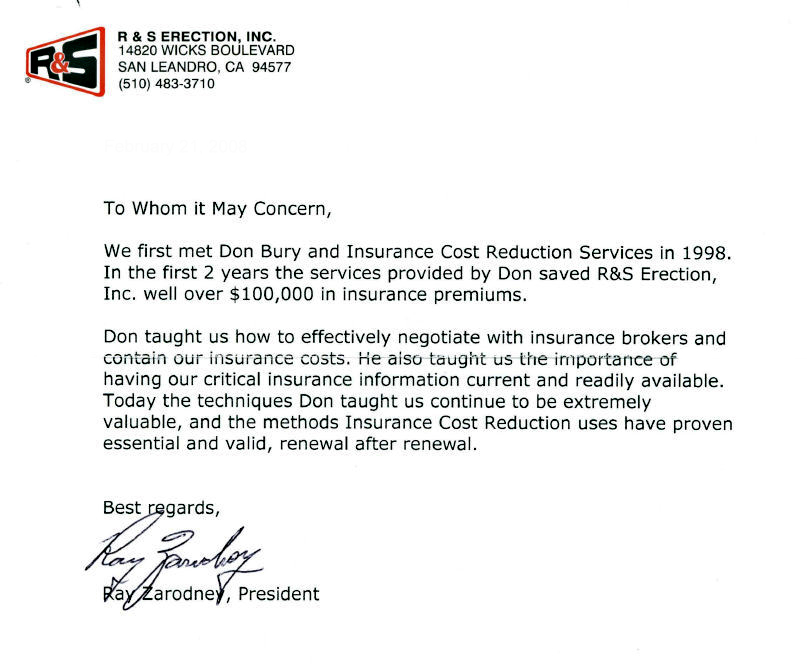

After hearing many times “Nice Book Don. Why don’t you do it for me?”, I took on the challenge, and started following my own directions helping clients.

The results shocked me. We saved millions of dollars in premiums for our clients. So the evidence shows the process works and is very worthwile.

Every business that adopts these methods will profit from suppressing costs and reducing their self-insured risks.